Last Updated on March 10, 2022

Contents

What is Mvelopes?

Mvelopes is a website and budgeting app available online or in the app store. This program allows you to sync your accounts (or manually track the accounts) in order to budget appropriately for your financial situation. It is available as a paid account with a free 30-day trial, meaning you have to enter your credit card information to gain access to the trial period.

In order to prepare for this and other budget programs, I highly recommend coming to the app with your financial information. Helpful information for budgeting can include logins, account balances, bills, student loans, and credit card information.

How can I get started with Mvelopes?

You can locate Mvelopes at mvelopes.com or on the app store. Here you can sign up for a free 30-day trial using your credit card. This is the promotion as of February 2022.

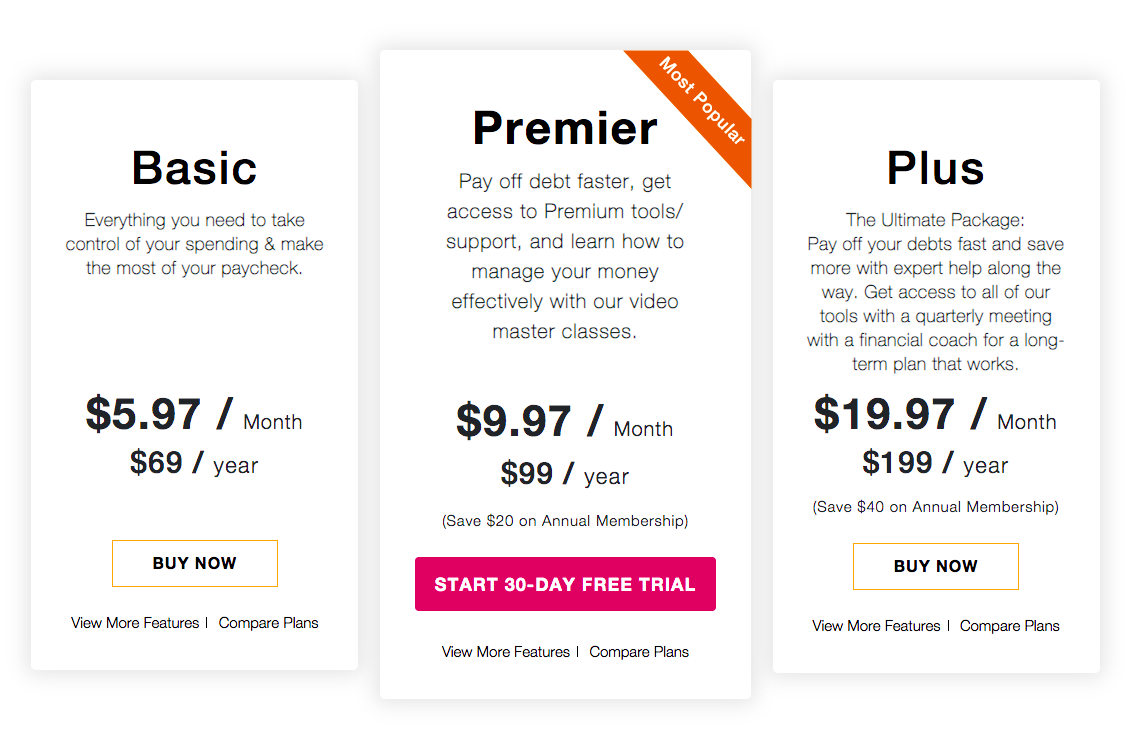

You will then have access to a free 30-day trial of the Premier plan. This will translate to $9.97 per month ($119.64 per year) or $99 per year ($8.25 per month). Other options are the Basic version: $5.97 per month ($71.64 per year) or 69 per year ($5.75 per month) or the Plus version: $19.97 per month ($239.64 per year) or 199 per year ($16.58 per month).

It seems that in all cases, paying for a year of service upfront will give you a greater discount. More information about each plan is listed below or at this link.

It seems that the big difference is the number of features that you have access to based on the amount you pay. Of note, if you pay for the premium level, you will have quarterly sessions with a dedicated personal coach. This could really be helpful for someone who is in any new budgeting situation and wants to be able to ask questions about how to make their money work best for them.

Just be sure that if you commit to a year, you check in with the app often enough to get your money’s worth! If you are unsure about the app, try the 30-day free trial and then pay monthly until you are sure you will commit to this budgeting app. Whatever you decide, make sure to set a reminder for yourself so that you can cancel use of the app before your trial period ends if need be.

If you decide to cancel and use a different method to keep track of your budget, you can cancel your subscription by logging into the website. Here you should click on the person icon (my account), then subscription info. Scroll to the bottom and click on the blue Cancel Subscription text. It seems that you are not able to cancel through the app.

How do you use Mvelopes?

By going to Account Summary at the bottom left of the page, you can add money by syncing your account(s) or adding an offline account – which means you do not have to sync your account. If you choose not to sync your accounts, you need to regularly update and refresh your total so that you are up to date on your account total.

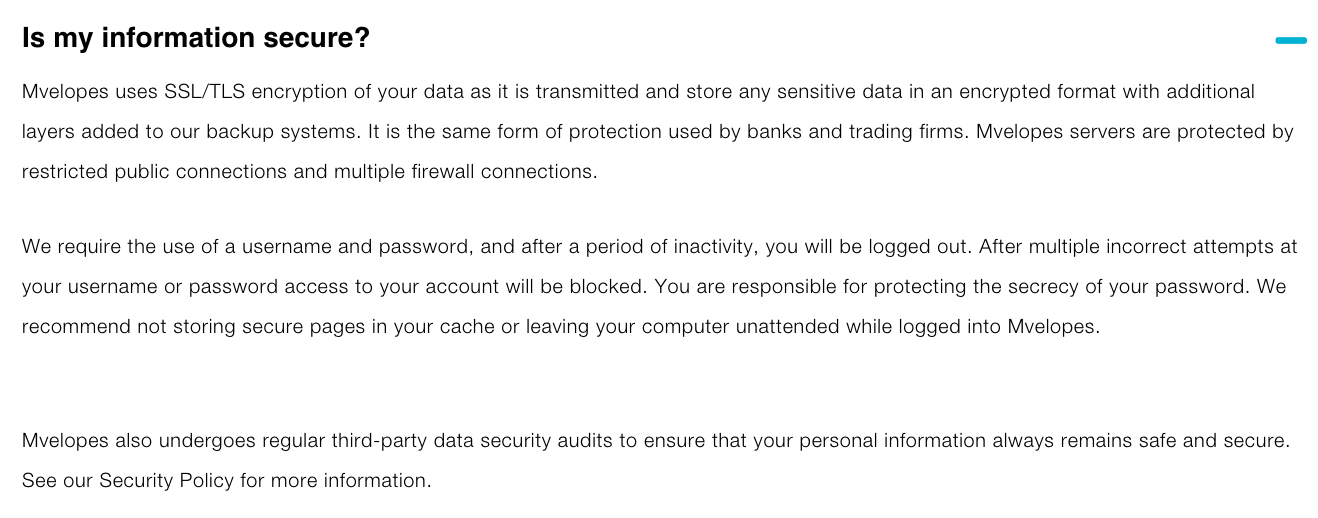

The app will automatically ask you to sync your account as soon as you login to begin setup. As always, Mvelopes guarantees that it is safe for you to sync your account with their program. Their statement on this matter:

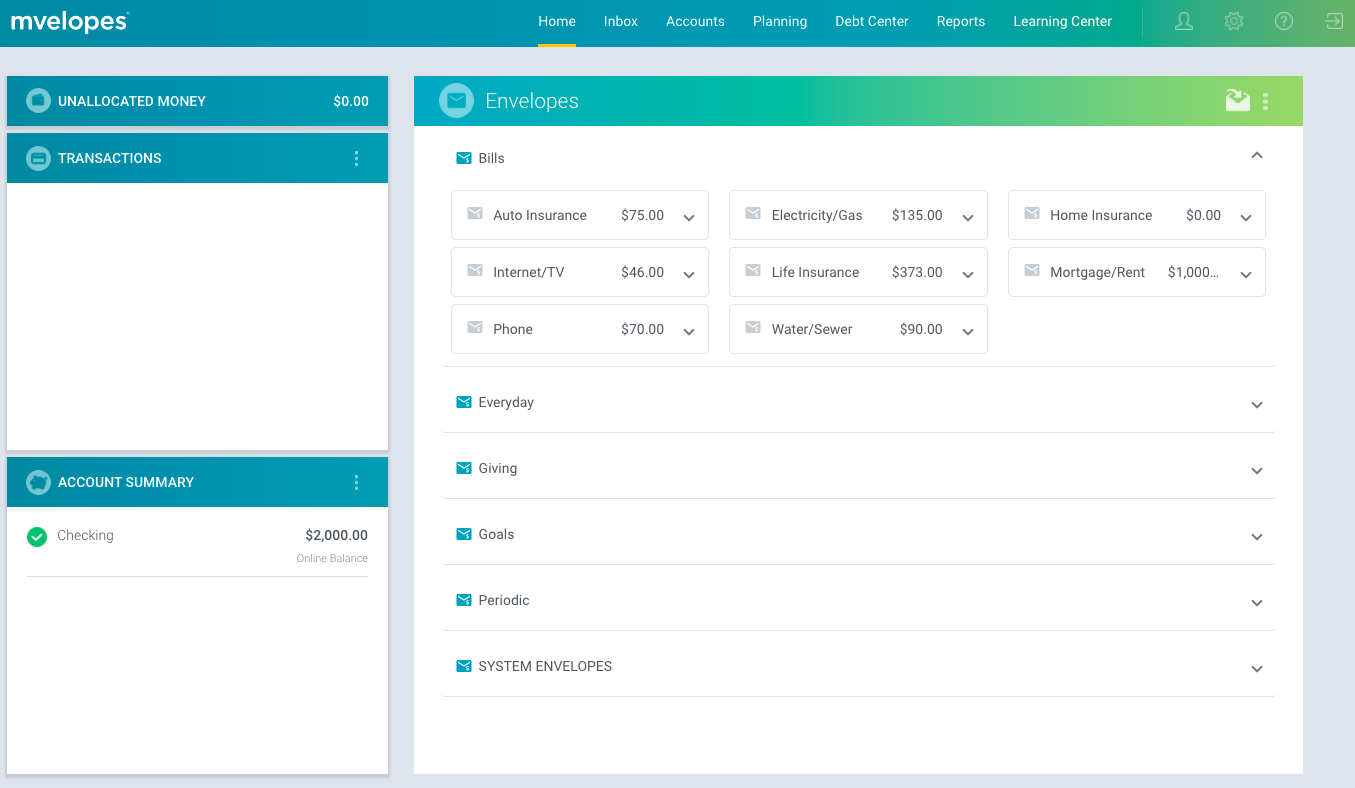

After you have inputted your account(s), you can begin setting up your budget. The home page will show you possible envelopes to use in your budget split into the following categories: Bills, Everyday, Giving, Goals, Periodic, and System Envelopes.

I highly suggest going through each and every envelope offered to ensure that you are making the most thorough budget possible. If you need to, you should also create or modify envelopes to your specifications. Remember, the more specific to your personal financial goals, the better!

Since this is a paid app, you should definitely make a note of it in your budget. For example, enter an envelope named Mvelopes into your budget, possibly in the Everyday section, and write your payment into the budget. This way, if you happen to forget to cancel, you have the payment already accounted for.

If you click on the envelope with an arrow icon at the top of the page, you will be able to fill the envelopes. When you fill the envelopes, the amount you started with in your accounts will be reduced until you have “spent” all your money. If you spend over the amount, you have available in your account, you will be alerted to it and have the option to make adjustments in order to fund your account.

Once you have finalized your budget, press the orange fund button at the bottom, and it will take you to a screen titled New Transactions. This is where you will keep track of the money you have spent. At any time, you can fund envelopes again by clicking on the orange fund envelopes tab at the top left of the Inbox/New Transactions page.

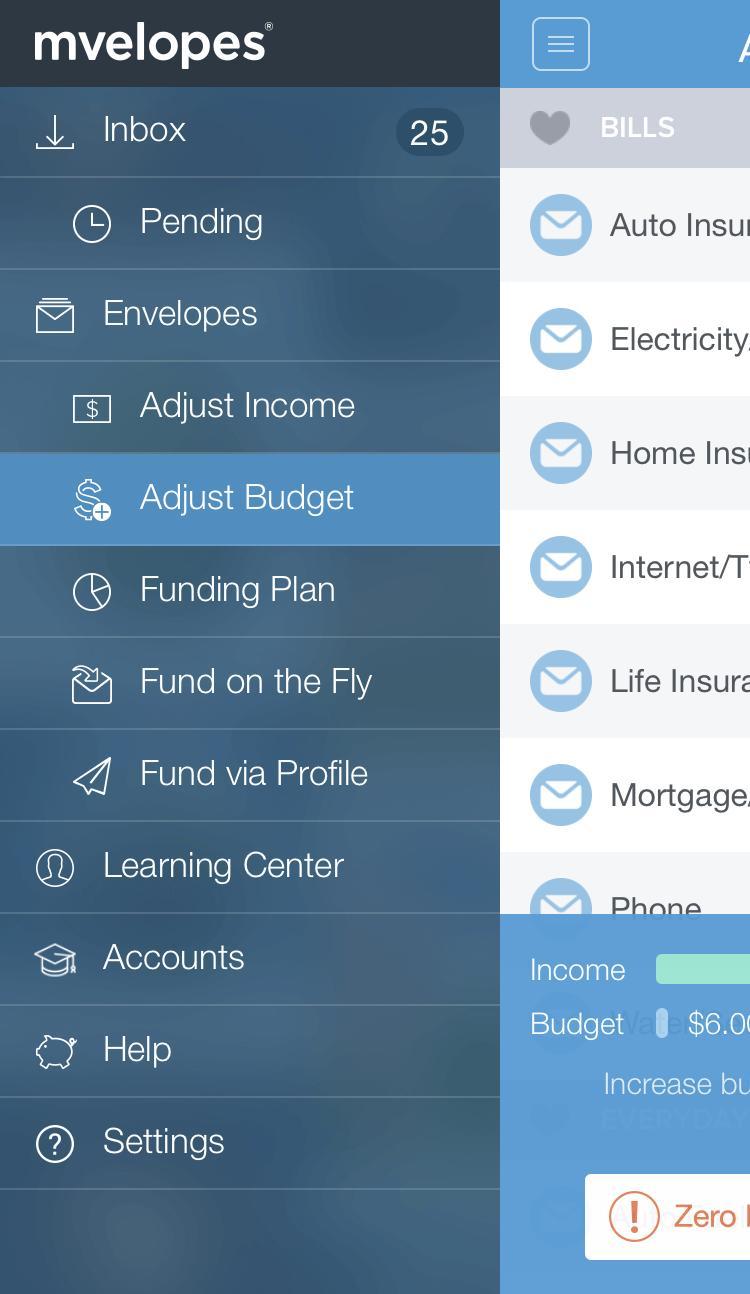

On the app, you can click on the menu button and scroll down to the Accounts tab in order to add a new account. Once you are on the page, click on the three dots on the top right of the page to sync a new account or add an offline account. In order to add a transaction, click on the inbox and then the three dots.

You will have the options of a plus sign to add a transaction and a search bar to look for a specific transaction. For each title of the menu page on the app, the way to make adjustments to that page is to click on the three dots on the top right and use the options that come up.

For example, on the Envelopes page, the options that come up are the search button, a sort button, an add envelopes button, a groups button, and an envelope transfer group.

You can then have your account sync to create the transactions that will go to your account, or you can manually enter your transactions by clicking on the three dots to the right of the page next to the all accounts drop-down menu.

If you add a transaction manually, you can even upload a picture of the receipt, which is an awesome feature to take advantage of. Other tabs at the top of the webpage and in the menu of the app are Accounts, Planning, Debt Center, Reports, and Learning Center. Below is a short overview of each.

The Accounts tab shows your current balance(s) and what account(s) you have synced or offline. It gives an update on how you are spending this month and can also show the status of your credit accounts.

The Planning tab is where you can add fixed or variable income. You can also specify a payday and how often you get paid. Once you have added all incomes, you can specify how that paycheck will be spent, and it will be allocated on the payday you have specified. This prepares your budget for the next few months, not just the month that you are currently working on.

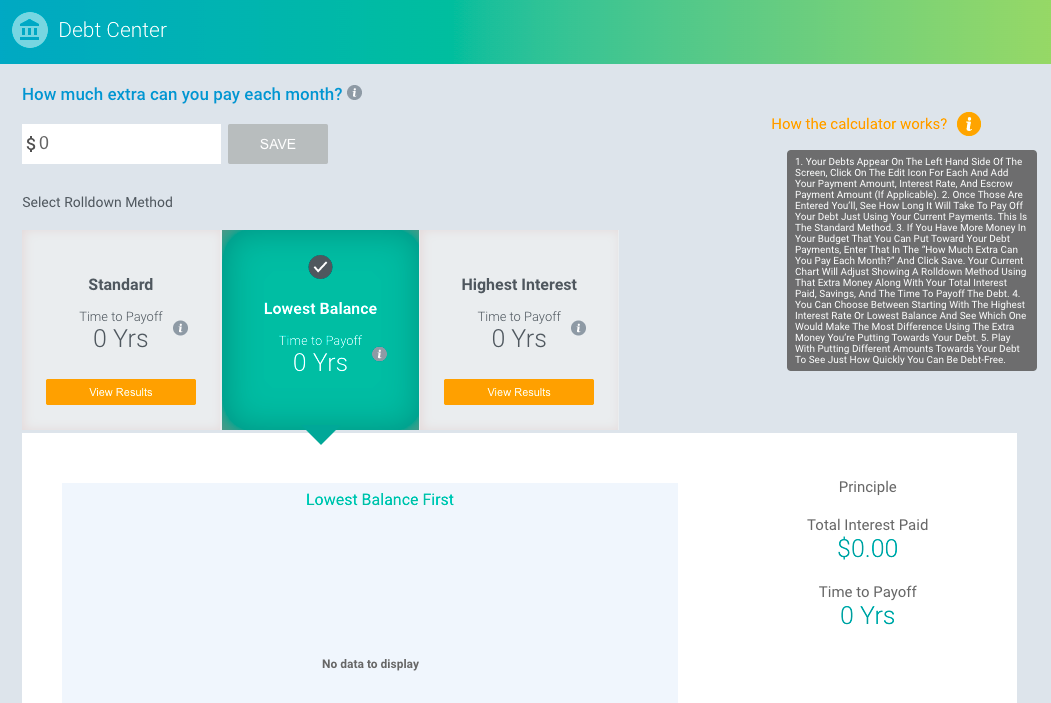

The Debt Center tab is where you can make a plan to pay off your debt in the best way for you. Here you can estimate how much extra money you can pay towards debt per month. Users can also view their debts and choose to prioritize paying them off in the standard way, by the lowest balance first or by the highest interest first. Once you have decided, it will estimate the time it will take you to pay them off.

The Reports tab allows you to view a variety of charts and graphs that represent your spending. This is to help you understand your patterns and where you can be better about how you spend.

The Learning Center is a resource to improve your relationship with money. There are quite a few classes that you can take in both video and book format online as a part of their membership. I always feel that it helps to have the support of app or web-based resources to help you get through the transition to better budgeting, especially if you are a beginner. However, even if you are not a beginner, it never hurts to be open to learning more about money!

All of these features are available on both the webpage and the app; however, some of the features have slightly different names. For example, instead of saying Planning on the app, as it does on the website, it says Adjust Income. If any of this is ever confusing to you, they offer a help and support page in order to make your experience run more smoothly.

What is positive about Mvelopes?

Mvelopes is a good way to get into the habit of budgeting. It offers a 30-day free trial. Mvelopes can make budgeting easier because it breaks down your budget into categories that will help you be specific about your spending. You can also sync your budget no matter where you are using it – on the webpage or the app.

Mvelopes keeps things simple by offering to have budget information carried over month to month. So, for example, if you pay the same bills every month, you will not have to reenter that information more than once because you can set it to repeat automatically.

Mvelopes also offers a Learning Center, which is always a huge advantage for the user. This really supports the learning of someone who is setting up a budget and attempting to be more disciplined in their spending.

What challenges might you face when using Mvelopes?

Learning how to use Mvelopes (like almost all other budget apps) can be labor and time intensive. Initial setup and maintenance will take some time, but eventually, you should be able to move more quickly through the app.

For example, determining what your budget will look like will take some time, but as you continue using Mvelopes, information will automatically show up on your app that will allow you to only spend a brief amount of time updating your budget.

Another negative is that you need to upload your credit or debit card information for you to have access to the app. Although it gives you a free 30-day trial, it will not automatically cancel. If you happen to forget to cancel your subscription, you will be charged whether or not you are using the app actively.

What’s the bottom line with Mvelopes?

Overall, Mvelopes is a user-friendly program that allows you to track your budget and manage your debt. If you are motivated to live your life on a budget, regularly checking in with this app could help you reach your financial goals. If you have not found a budget app that you feel is right, this may be the one for you.

What questions should I consider before determining if Mvelopes is right for me?

Everyone can benefit from using this app if they have the money in their budget to pay for it. This program can keep you aware of where your money is going every month and then give you a chance to reflect on how you are spending and how you can make improvements month to month. If you are unsure, however, here are some things to consider before deciding to start:

- Do I currently budget? Would my system be improved by using Mvelopes instead if I currently am?

- If I am not currently budgeting, would Mvelopes give me inspiration to budget?

- Since I have to pay for Mvelopes, will I utilize it appropriately to get the most value for my money?

- If I do not use Mvelopes, how will I ensure that I practice positive financial habits such as spending less than I make and getting my money into savings, paying off debts, and building wealth?

Consider these questions on your own and then with a spouse or accountability partner. Figuring out the best method for budgeting for you is the best way to make sure that you will follow through on budgeting.

So, if you are considering using the Mvelopes to help you budget, I find that it is low cost, user-friendly, and helpful in keeping track of not only your budget but all accounts you utilize.

Mvelopes also helps to motivate you to budget appropriately by showing charts and using graphics to track your budgeting habits, as well as offering a well-rounded financial education to help you learn more about how to manage money.

Make sure to give yourself time to properly use Mvelopes, at least 2-3 months if you can afford it, before making a final decision about it. This will allow you to see in real-time, and with others, such as your accountability partner, if the program is right for you and if it can really make a difference in your life.