Last Updated on May 29, 2021

Contents

What is Every Dollar?

Every Dollar is a budget program with an app designed by Dave Ramsey and Ramsey Solutions. It is available in the US and Canada. The program is based on Dave Ramsey’s belief in a zero-based budget system and allows you to plan how you will spend each month’s income before you receive it.

Every Dollar is a free budget program with a paid version available. The paid version is a subscription service that includes access to Dave’s programs like Financial Peace.

Overall, this program is incredibly helpful and has the possibility of bringing great clarity to your financial life. Every Dollar allows you to make the best financial decisions possible. If you are looking to budget online or just start budgeting regularly, this could be the way to go!

What Is a Zero-Based Budget?

Budgeting is essential to helping you meet your financial goals. Dave Ramsey’s version of budgeting is a Zero Based Budget. Put simply, a zero-based budget says that your income minus your spending should equal zero dollars. You have purposefully spent every part of your income in some capacity – expenses, giving, savings, debt payoff, or investing. The Every Dollar App is based on this principle.

Here’s an example: in the month of May, your income is $2500. By using the zero-based budget format, you account for how you will spend that money as precisely as possible – $100 for savings, $400 for food, $1000 for your mortgage, $200 for gas, $100 for giving, and $700 on debt payments. According to your budget app, you have $0 left to spend – but this just means that you have put all of your income into specific categories, and you are committing to spending your money in that way.

While you may feel like you have $0, you have actually just given yourself the power to spend your money where you planned. When you make your budget, remember that you are in charge and have the power to make adjustments as needed if necessary.

How do you use Every Dollar?

Getting started is simple. The first thing you need to do is create an account. You can do this by getting on the website everydollar.com or by downloading the Every Dollar app. It is free to join and download. Use an email and password that you will remember or keep a record of it.

Once you have created your login, you are ready to budget! Every Dollar will ask you some questions about where you are in your life and what kind of financial goals you have for yourself. It is great to have an idea of what you want so that in your future, you can use that as motivation – because budgeting can be a challenge!

You can skip this part if you are unsure or are short on time, but I highly suggest revisiting this when you can. It may be helpful to write them down and keep them in a location where you see them often so that you remember why you embarked on this zero-based budget in the first place.

Website

An example of what the goals section looks like in the introductory portion of the EveryDollar app.

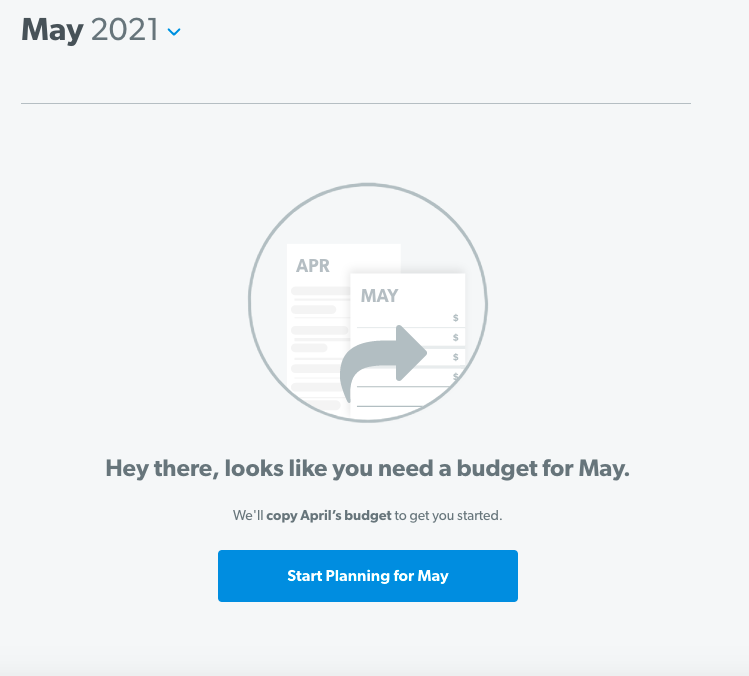

While you are preparing to use the app, it may be helpful to have your income, and bill amounts available so that you don’t have to spend too much time looking for those while you update your budget. Some of your initial “planned” expenses may feel like guesswork, but that is normal and will improve over time. The first few months will have a learning curve. To enter these numbers, start by going to the next month available and “Create ____ Budget” or “Start Planning for ___.”

Website

An example of what your website would show when you are preparing to enter information for the first or next month of your budget.

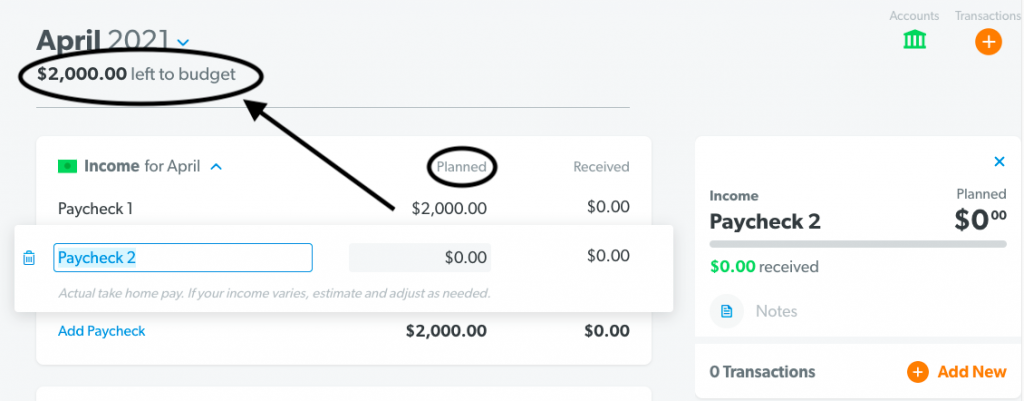

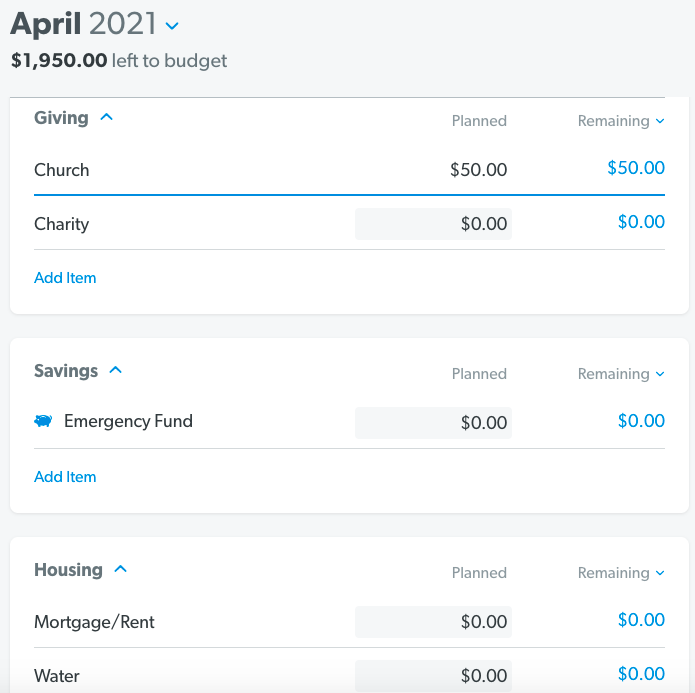

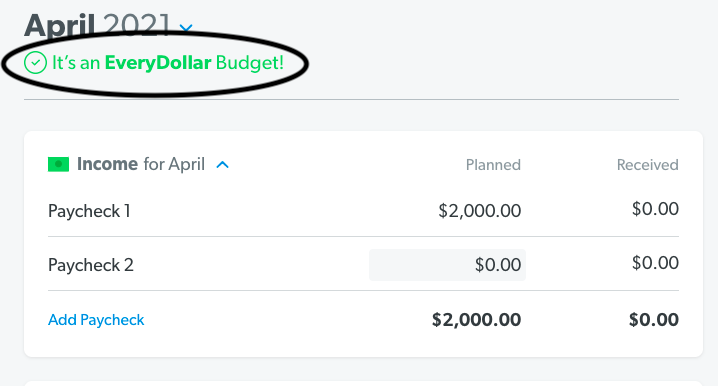

Enter your income(s) in the Income Section under the “Planned” tab. You have the option of adding multiple incomes and can rename them as needed. In order to add any income, click the blue “Add Income/Paycheck” button at the bottom of the section. You can also rename the item by clicking on the title. This may be helpful in making sure that you are keeping track of all incomes.

You may have more than one person who works in the household or many sources of income, and they might seem less complicated if you can easily account for all of them. Once you have added incomes, you will be able to see your current status at the top of the app or website. It will tell you in real-time how much money you have left to spend, how much you have overspent or that “It’s an EveryDollar Budget!”

EveryDollar Website App

The “Planned” columns with income added and the “left to budget” amount showing.

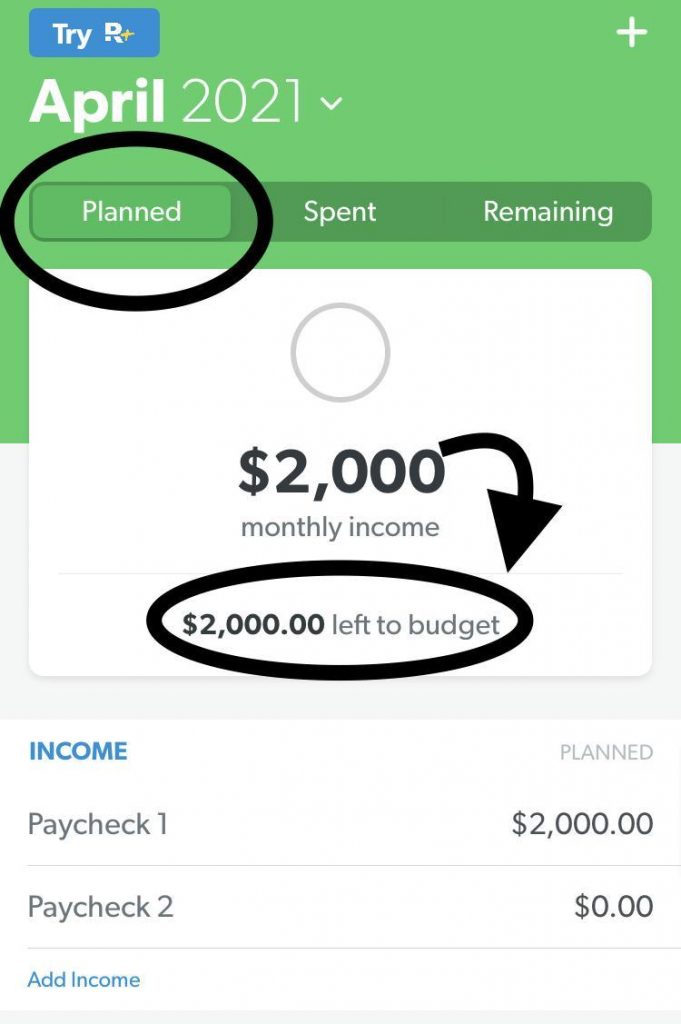

Once you have set up your income, the app or website will take you through possible expenses that you make throughout the month, including your rent/mortgage, personal spending, and debt payments. You input these into the Planned category, and then your amount left to budget will update automatically as you input more information.

At any time and in any category, you can add to the list to ensure that you are covering every expense that you personally have. Here’s a resource to help you remember as many of your expenses as possible. I find it very helpful to look through my bank and credit card statements for the past 2-3 months to view all charges and make sure they are accounted for somewhere in my budget.

It can also be beneficial to think about and apply any charges that may occur only once a year or less often than once a month. Add those in their appropriate column and then consider saving for that throughout the year (for example: $100 total payment or $8.33 per month for 12 months) or leaving it there as a reminder to include the amount when it is the correct month.

Website App

Examples of expenses that you can add if they apply to you with the “left to budget” shown.

While you are adding expenses, your app will give you feedback on your current budget status as mentioned above. Your goal is to spend Every Dollar – hence the name of the app. This does not necessarily mean that you are spending frivolously; it just means that you are assigning every dollar a specific purpose. If you are lucky to have too much money left once you have inputted all your expenses, consider assigning that money to savings or larger debt payments.

Dave Ramsey would advise you to follow the seven baby steps, which include saving $1000 for emergencies, paying off all debt, saving for 3-6 months of an emergency fund, saving 15% of your total income towards retirement, saving for your children’s college fund, paying off your mortgage and building wealth and giving.

If you are inclined to follow this advice, you could consider which step you are on and contribute to that. For example, if you have no savings, open a savings account, create a line for savings in your budget, and put your excess money in that line. There is more information about this process included in the “Profile” section of the app or the right-hand column of the website.

If you happen to be over budget when you complete your expenses, look back at where and how you are spending and attempt to make cuts. It is important to remember that this is a process, so you should get better at how to cut from your budget over time. Dave Ramsey would suggest you keep your most vital “four walls” covered – housing, utilities, food, and transportation.

Cut from other areas so that you are able to keep your family safe, warm, and fed for as long as possible. For now, do your best to make the decisions you feel will best benefit your family, and over time, you will learn where to make the changes.

If your app says “It’s an Every Dollar Budget,” congratulations! You have succeeded in putting all your money into specific categories that will help you do better in the future.

Website

Congratulations! You are on track to being a successful budgeter!

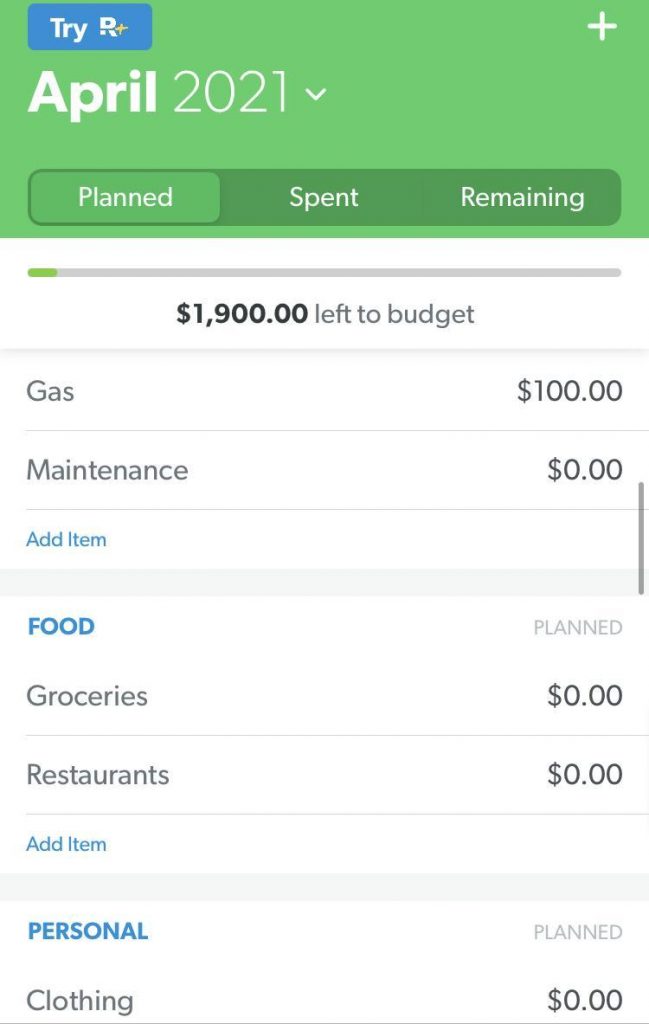

Once you have created your budget, you can now log back into the app or website as often as you’d like to track your expenses. It may be beneficial to set a date with yourself as a reminder in your calendar or phone to do this – at least weekly.

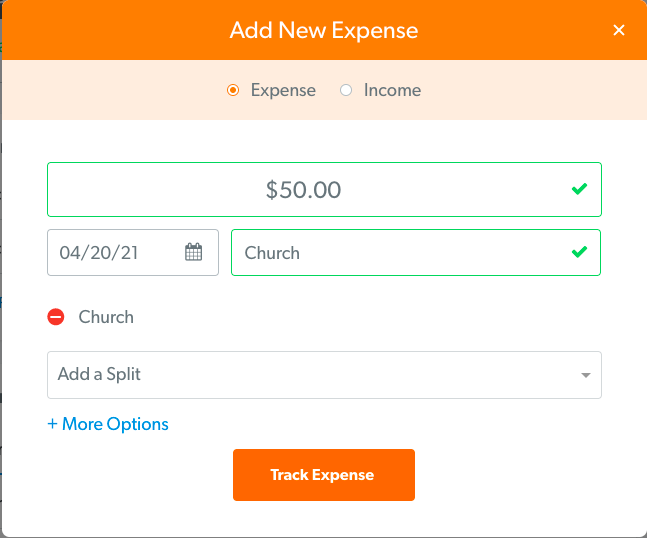

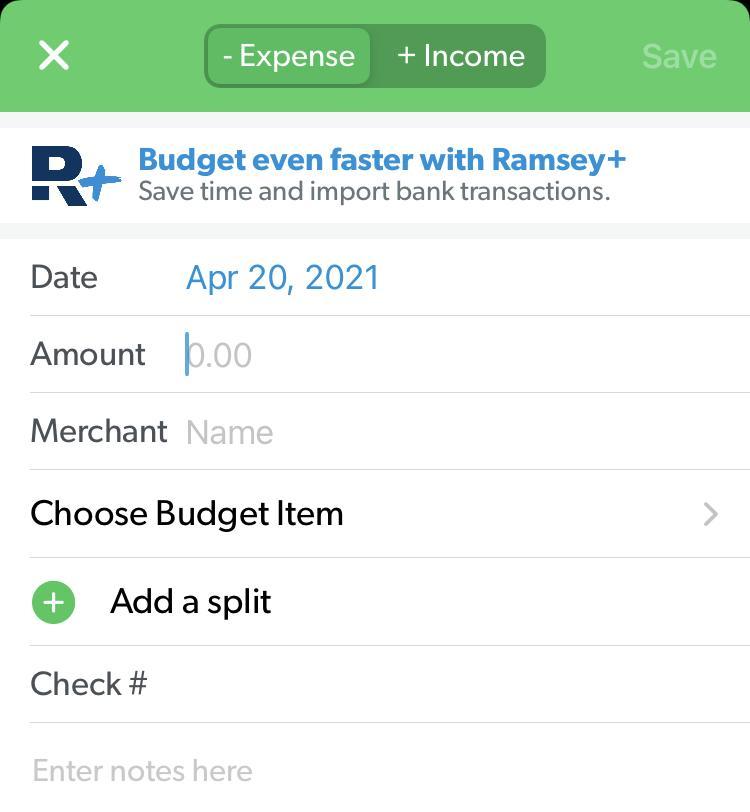

To do this, click on the + button and add a transaction. Enter the amount you spent, where you spent the money, add it to a correlating category, a check number (if applicable), and notes to help you remember how and why you spent if you’d like. This is vital to the process because unless you sign up for Ramsey +, you will have a budget but not be able to reflect on how you are spending.

You can also now switch between the Planned, Spent, and Remaining tabs at the top of the app or the Planned and Remaining tabs on the website. This can be a helpful reminder of how and where you have spent overall and how much you have left in each category to spend. There is also a circle graph on the side of the website and top of the app that gives each spending category a percentage. It is helpful to see where you may be over or underspending.

Website App

When tracking, you have the option to enter an expense or income, the amount, the date, where you spent or earned, and a related category, such as Church.

You can also add a split within a transaction. This can be beneficial if you made a big trip to the store and spent money from several categories but paid with the same transaction. For example, if you spent $100 at Target, you could break down this expense into $50 for your kids and $50 for groceries. You can add many categories and make specific notes about each transaction if necessary.

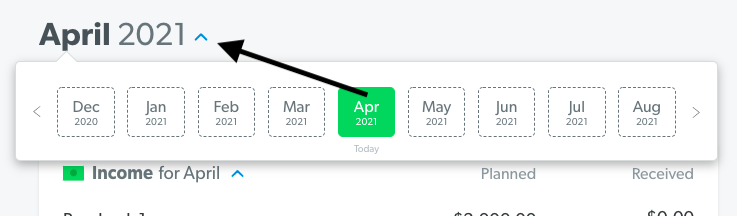

At the end of the month, you have the opportunity to prepare for the next month. Make sure you have completed as much of your current month’s budget as possible so you can use that information to reflect on how to do better in the upcoming month. At the top of the website or app where it says the month and year, click the blue arrow, find the next month, allow it to set up your budget or start from scratch, and make your budget dreams come true!

Website App

Set up next month’s budget by clicking on the arrow next to the month and year date.

What is great about Every Dollar?

Every Dollar is a great way to budget. It is a free and very simple, and straightforward budgeting app. This app has made budgeting easier because everything is in one place. Spouses and accountability partners can share a login to ensure that each person has access to the budget. It can be viewed on multiple devices.

Once you have set up your app, the information will carry over month to month, and you will only have to update it. For example, if you receive the same income every month, you will not have to adjust that. It will automatically update for you when you start a new month.

It is very easy to make adjustments at the start of each new budget or even throughout the month to any part of your budget. All you have to do is go back to the app or website to do so. You can go to the Planned tab and update what you need very quickly and easily. As long as your bottom line says, “It’s an Every Dollar Budget,” you are on the right track.

Every Dollar is free! You do not have to pay to use the app unless you want to upgrade – then you can link a bank account if you choose. According to this article, Every Dollar is completely secure and available to link to thousands of banks. You can even request to have yours added if it is not already there!

A benefit over using a paper version is that most likely, you will always have your phone with you, with the app on it, and will be able to ensure that you have enough in the category you are considering spending on before you spend. If you have some downtime, there are even a few budgeting resources available for you on the app.

What challenges might you face with Every Dollar?

For one thing, using Every Dollar can be labor and time-intensive. If you want to be semi-accurate, the user has to gather the previous month’s spending information in order to get it set up. If you choose the free version, you have to update and track your spending often in order to make sure that you stay on track and under budget. Basically, if you are not highly motivated, it may be difficult for you to complete the process of tracking your budget after setting it up. Many people find that they don’t want to spend their time keeping up with the budget; therefore, they will not continue using the app.

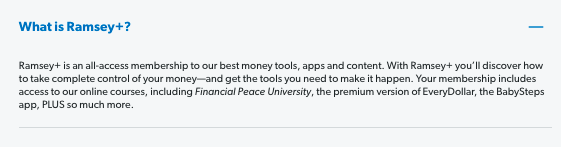

Website

This is a brief description of what Ramsey + offers.

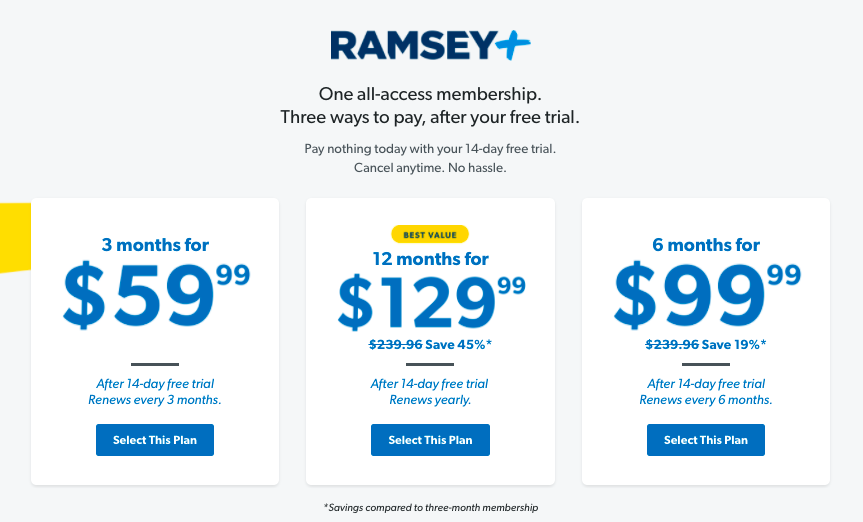

Another negative is that if you choose the paid app, it costs much more than it used to. The paid version allows you to connect to a bank account that automatically tracks your budget, but it now also connects to Ramsey +. This program is about learning and classes, which means you will be paying around $130 a year for the subscription – and you can’t pay monthly.

While this may be worth it if you need to learn how to best budget and spend your money, it is more costly than it used to be. If you are truly dedicated to turning your financial life around, you could consider using this as an investment – and a line in your budget – at learning how to best manage your money now and in the future.

Website

Ramsey + Pricing as of April 2021

Lastly, although the app tracks your budgeting, it does not keep track of what you have in savings and investment accounts. This can be a turnoff for some people who want to have all of their financial information in one place.

What’s the bottom line on the Every Dollar app?

Overall, for a free budgeting app, Every Dollar is user-friendly and a great way to get a complete picture of your spending. If you are motivated to live your life on a budget, this is an app that you can commit to that will help you to achieve your financial goals. This program is beneficial for individuals and small families who are trying to get on and live with a budget. It could also possibly work for small businesses, but other software may be a better option for that. It is definitely worth at least a few months of trial with your time.

If it is not for you, you can always email help@everydollar.com, and they will process the deletion of your account within two weeks. Hopefully, however, you will build great budgeting habits over time using this app.

What questions should I consider before determining if Every Dollar is right for me?

I believe that everyone can benefit from using either the free or paid-for version of this app if they have the money to invest. It is a great program that can keep you fully aware of where your money is going every month and then give you a chance to reflect on how you are spending and how you can make improvements month to month. If you are on the fence, however, here are some things to consider before deciding to start:

- Do I currently budget? Would my system be improved by using this app instead if I currently am?

- If I am not currently budgeting, would Every Dollar give me inspiration to budget?

- Do I have the time it takes to input everything throughout the month, or should I consider paying for Ramsey +?

- If I pay for Ramsey +, will I utilize it appropriately to get the most value for my money?

- If I do not use this app, how will I ensure that I practice positive financial habits such as spending less than I make and getting my money into savings, paying off debts, and building wealth?

Consider these questions on your own and then with a spouse or accountability partner. Figuring out the best method for budgeting for you is the best way to make sure that you will follow through on budgeting.

In conclusion, if you are considering using the Every Dollar App to help you budget, I find that it is free, very user-friendly, and helpful in keeping track of your spending month to month. It also holds onto your records of budgeting for quite a long time if you need to look back at how you spent your money in a particular time period.

Make sure to give yourself time to properly use the app, at least 2-3 months, before making a final decision about it. This will allow you to see in real-time, and with others in your life, if the program is right for you and if it can really make a difference in your life. Here’s to your future budget!