Last Updated on March 31, 2023

Contents

- 1 A Review Of The Best Budgeting Apps Available On Your Phone or Tablet

- 2 What are the Apps and which user type are they best for?

- 2.1 Every Dollar: Best for Beginners

- 2.2 Goodbudget: Best for Budgeters who Want to Learn

- 2.3 Mint: Best for People Who Want a Complete Financial Picture

- 2.4 Mvelopes: Best for People Paying Off Debt

- 2.5 Pocketguard: Best for People Looking Beyond the Budget

- 2.6 Wally: Best for People Who Hold Foreign Accounts

- 2.7 You Need a Budget: Best for People Who Want Simplicity

- 3 What’s the bottom line?

A Review Of The Best Budgeting Apps Available On Your Phone or Tablet

Are you struggling to budget to meet your financial goals? Wealthyish.com has previously reviewed multiple of the best budgeting apps on this site already but this article will compare the different options all in one place. However, you can click on any of the following links to get our more in-depth review of the apps including Every Dollar, Goodbudget, Mint, Mvelopes, Pocketguard, Wally, and You Need a Budget – to hopefully help you find a budget app that works for you!

Why does Wealthyish.com recommend the practice of budgeting? It is because budgeting is an often-overlooked tool that can change the way you handle your money for the better. It makes you aware of your spending and keeps you accountable for your financial goals. Budgeting with an accountability partner and using tools like our half payment method calculator makes you even more successful!

If you are already budgeting regularly, you may want to consider “shopping around” for another budget system such as one of these apps. It is especially helpful if you feel you are not doing as well as you can with your money. It may also be beneficial to check out these apps if you haven’t changed your system in a while. You may be surprised to find that another app (with new and/or different technology) may offer more insights into your financial situation.

These apps are recommended based on who the best audience is for each one. If you fit in more than one audience, feel free to give them all a look. Most of them offer a paid-for version. It is important to do your research before paying if possible. Most offer a free trial period, so take advantage! All prices are current as of March 2023.

What are the Apps and which user type are they best for?

Every Dollar: Best for Beginners

| Cost: Free or up to $129.99 Annually ($10.83 Monthly) |

| Pros: Zero-Based Budgeting / User Friendly / Financial Resources Available |

| Cons: Does Not Track Savings or Investment Accounts |

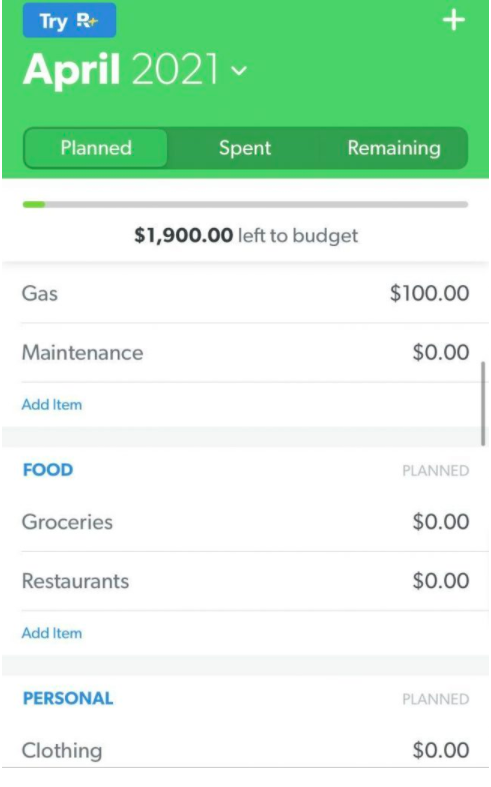

Every Dollar is a wonderful resource for beginner budgeters. It is simple, straightforward, and allows you to plan for your month with a zero-based budget. There is a very clearly marked “Left to Budget” line at the top so that while you are planning, you can see how much money you still need to account for.

Once you have “spent” every dollar in your budget, it will clearly tell you so. You can choose to sync your bank account (in the paid-for version) or track your spending yourself with the free version. Every Dollar also offers educational resources to support beginning (and experienced!) budgeters. This is incredibly beneficial to supporting your hard budgeting work!

To see our full review of Every Dollar, click here.

Goodbudget: Best for Budgeters who Want to Learn

| Cost: Free or $70 Annually |

| Pros: Digital Envelope Budgeting / Sync and Share Budget with Accountability Partner / Financial Resources Available |

| Cons: No Account Syncing |

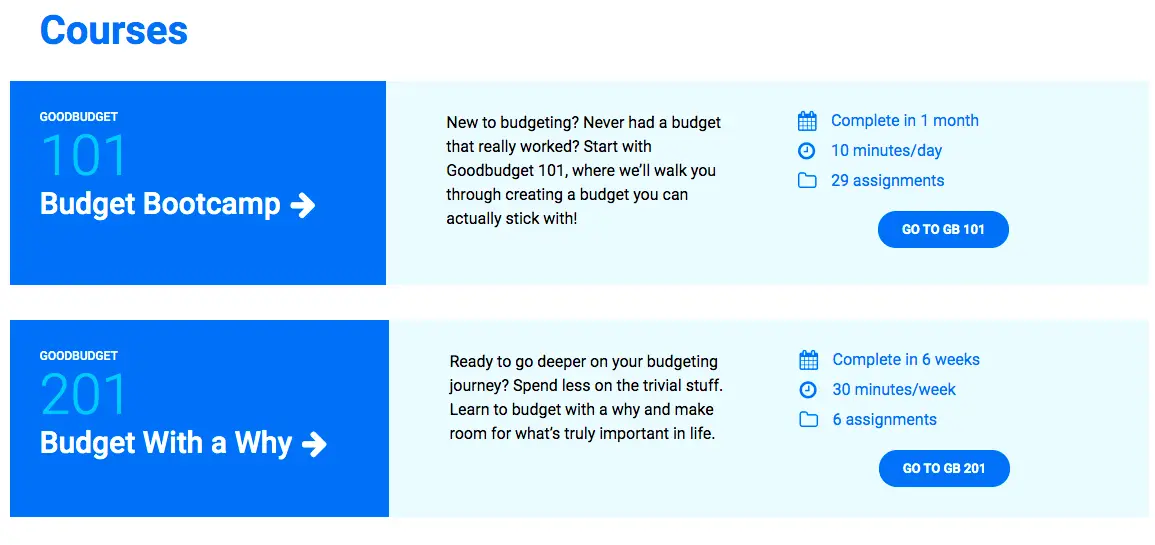

Goodbudget is a program with many great features, including courses specific to helping people achieve success with their finances. Because of this, it is likely that people who use Goodbudget consistently will achieve their financial goals and learn quite a bit about how to successfully manage their money.

On top of offering a very large catalog of classes on how to manage your money, you can share your information with an accountability partner, track your debt and save for big expenses (hello, financial goals!). Both a free and paid-for version of this app are available. In comparison to other apps, the paid-for version is offered at a relatively low price.

To see our full review of Goodbudget, click here.

Mint: Best for People Who Want a Complete Financial Picture

| Cost: Free |

| Pros: No Upgrades Necessary / Gives a Complete Financial Picture / Syncs Accounts |

| Cons: In-app Ads |

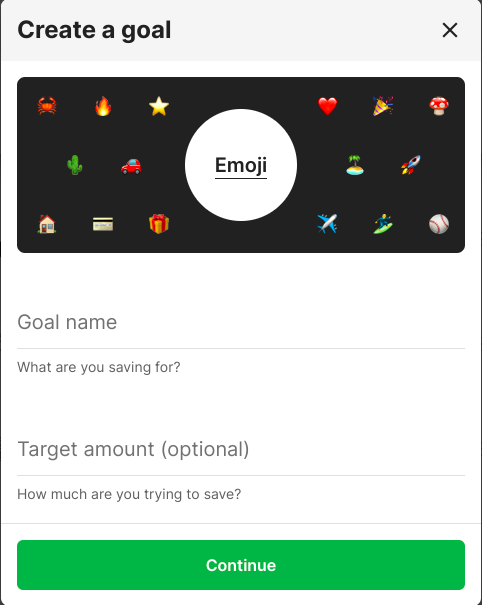

Mint offers many features, such as Goal Setting.

Mint is one of the most used, best budgeting apps due to having a one stop shop website that is incredibly extensive – and FREE! (Did we say this puppy is free already?) There are no optional upgrades; all features are included. This is an incredible resource for anyone looking to incorporate all their financial information – budgeting, financial goals, checking, saving and investment accounts, and more – in one place.

You also have the option to track your credit score and use their ‘Ways to Save’ service to attempt to lower some of your bills. While it can seem like it requires a lot of information, you can pick and choose what you utilize within the app and add more information over time. This is a budgeting app everyone should at least check out!

To see our full review of Mint, click here.

Mvelopes: Best for People Paying Off Debt

| Cost: Multiple Levels Available Ranging from $69 – $199 Annually |

| Pros: Debt Center / Financial Resources Available / Free 30-day trial |

| Cons: Debit or Credit Card Number Required to Join |

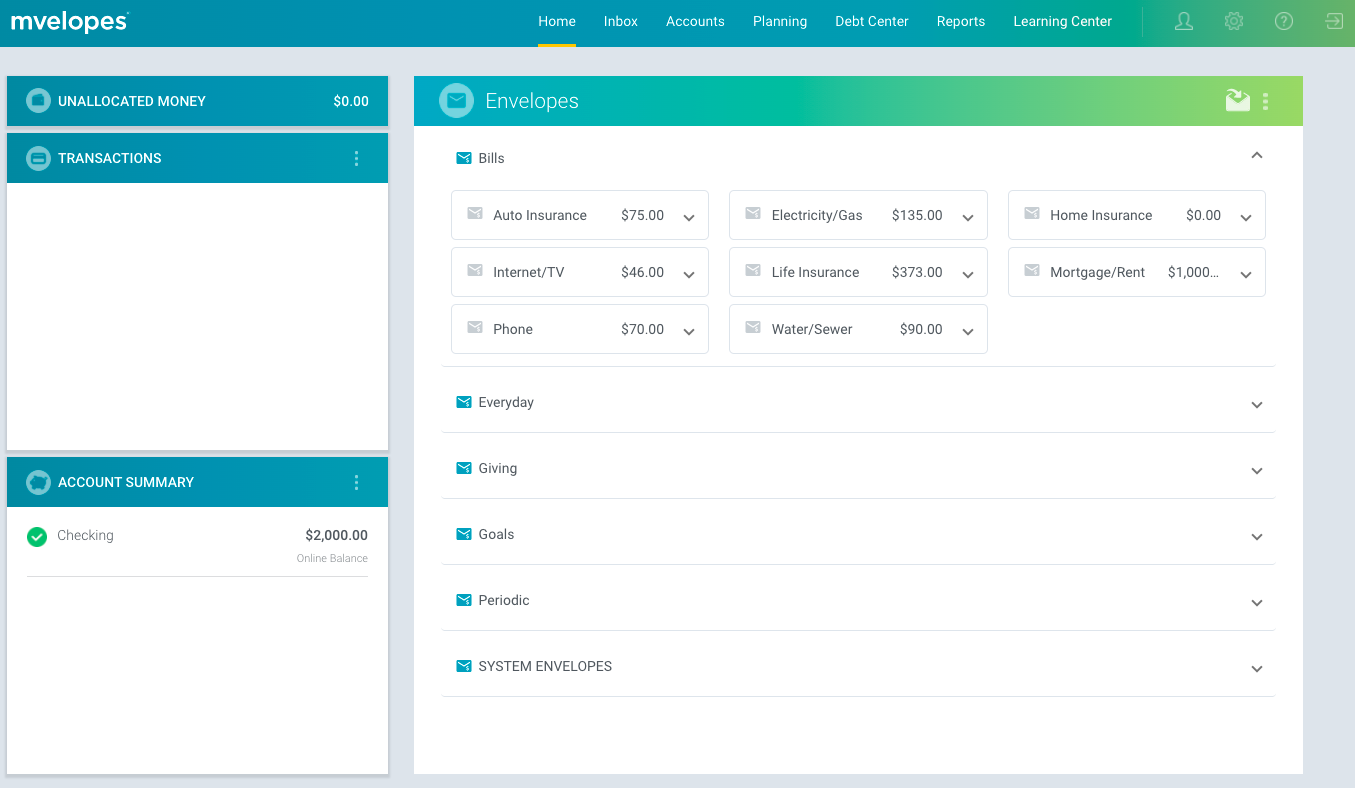

Mvelopes is a great program for any budgeter but could be extra helpful for those who are looking to reduce debt with detailed planning. Mvelopes helps their budgeters with a debt center that allows you to make a debt reduction plan that best fits your lifestyle. You can choose to pay off debt in two ways: high-interest accounts first, or lowest amount first.

In either option, the debt center will help you keep track of your progress and predict when you will finish paying off debt using your plan. This is incredibly helpful for people who are trying to stay motivated to pay off debt.

Mvelopes offers educational lessons to support your debt payoff and budget strategy, and at the premium level, you are given the option to meet quarterly with a financial coach. This is a unique option to the apps in this article and can really boost your progress!

To see our full review of Mvelopes, click here.

Pocketguard: Best for People Looking Beyond the Budget

| Cost: Multiple Levels Available Ranging from Free – $99.99 |

| Pros: Debt Center / Blog Available / Financial Goal Setting Tool |

| Cons: Can be Overwhelming to New Budgeters |

Pocketguard is one of the best budgeting apps in that it allows you to look beyond the budget. Like Mint, it offers a budgeting tool and offers goal setting, debt reduction plans, bill tracking, and a service that attempts to secure savings on monthly bills. These features allow you to look at a larger picture than just what you are budgeting for monthly, which will hopefully help you stay motivated to continue living your life on a budget. Another positive aspect of Pocketguard is that it can be free or paid for up to a lifetime, translating to a lifetime of savings if you utilize the app consistently.

To see our full review of Pocketguard, click here.

Wally: Best for People Who Hold Foreign Accounts

| Cost: Multiple Versions Available from Free – $99.99 |

| Pros: Syncs All Accounts – Including Foreign / Location Sharing to Track Transactions in Real-Time / Create Groups to Share Information Easily |

| Cons: Only Available as an App |

Wally is one of the best budgeting apps or program for individuals or couples who wish to be able to sync not only the different accounts they have within the United States but also those they may keep internationally. It boasts syncing with over 15,000 banks in 70 countries – truly unique within the group of apps that are reviewed in this article.

Wally also offers other beneficial tools, such as budgeting, group sharing, a financial calendar, bill and receipt uploading, and insights to show how you are spending. While Wally is only available through an app, it is very beneficial for those who are trying to incorporate all their accounts into their budgeting system.

To see our full review of Wally, click here.

You Need a Budget: Best for People Who Want Simplicity

Cost: $84 Annually

Pros: Unlimited Synced Accounts / Financial Resources Available / Highly Adaptable

Cons: No Free Option After Trial Period

YNAB opens with a guided tour that helps you get your first budget set up.

You Need a Budget (YNAB) is an incredible app for those who wish to keep their budgeting simple. YNAB starts by giving a guided tour that you complete while setting up your budget. This is extremely helpful. YNAB also gives detailed “envelope” names that can help ensure that you do not forget any important lines in the budget – including paying for YNAB itself!

YNAB also encourages you to adjust your budget throughout the month if you are worried about overspending. Turning a category red will alert you that you have overspent in that column and give you the opportunity to move money from another area. YNAB also supports its users by including financial education through a blog, podcast, guides, and videos. This is a great tool for supporting you through what can be an arduous process!

To see my full review of You Need a Budget, click here.

What’s the bottom line?

In conclusion, there are many great budgeting programs that vie for the title of best budgeting apps. These seven all have different features, and I am certain one of them will work for you. So go ahead, take advantage of free apps and free trials if you are still unsure, but this will put you on the best track to security. Use the apps you find most appealing for a month before deciding to commit to just one. Once you choose, make sure to go back and delete any pertinent information (and maybe even the account itself!!). By using a budgeting app that lets you focus on your personal finances, you will meet your wealth goals in much more readily!